Inventory Accounting

On-hand inventory isn’t simply stock that hasn’t sold yet - it’s a business asset, and must legally be treated as such. Inventory accounting is the practice of correctly valuing this business asset, so it can be properly documented in end-of-year financial records.

This chapter covers the basics of inventory accounting for greater understanding of inventory management as a whole. But it is highly recommended to seek the services of a professional accountant and/or bookkeeper when it comes to submitting any financial documents.

What is inventory accounting?

Inventory accounting is all about how a business would show the stock it holds in its financial records - balance sheets, profit & loss (P&L) reports, etc. This is typically more complex than it sounds as inventory is often a 'live figure' that's constantly changing as sales are made and more stock purchased.

In retail, this can cover three types of inventory or production phases:

Raw materials.

In-progress items.

Finished products ready for sale.

Your on-hand, unsold inventory needs to be included as an asset in end-of-year financial records. Meaning the crux of the matter in all this is to correctly track both the cost of any inventory sold and place an accurate value on the unsold inventory being held at the end of each accounting period.

Any increase or decrease in the value of goods affects your inventory value figure. This then, in turn, affects the value of your overall business.

Inventory accounting key terms

There are two key terms retailers need to be aware of when it comes to inventory accounting:

Cost of goods sold (COGS): The direct costs of producing any goods sold by a company.

Ending inventory (EI): The value of any unsold, on-hand inventory at the end of an accounting period.

Let's take a deeper look at each of these...

1) Cost of goods sold (COGS)

Cost of goods sold (COGS) is a core element of measuring a retail business’s profitability and inventory value.

As the name suggests, COGS refers to the amount it cost a business to produce the products it sold, including everything that went into it - materials, labor, tools used, etc. But (crucially) without factoring in costs not directly tied to the production process - like shipping, advertising and sales force costs, etc.

As a result, COGS helps you determine the amount of gross profit made in one or more sales.

For example:

If you sell an item valued at $50 and the COGS is $30, your company has achieved a gross profit of $20. It’s a simple formula, though it can become more complex if manufacturing your own products.

All inventory sold will be listed under the COGS account in your income statement at the end of each business year.

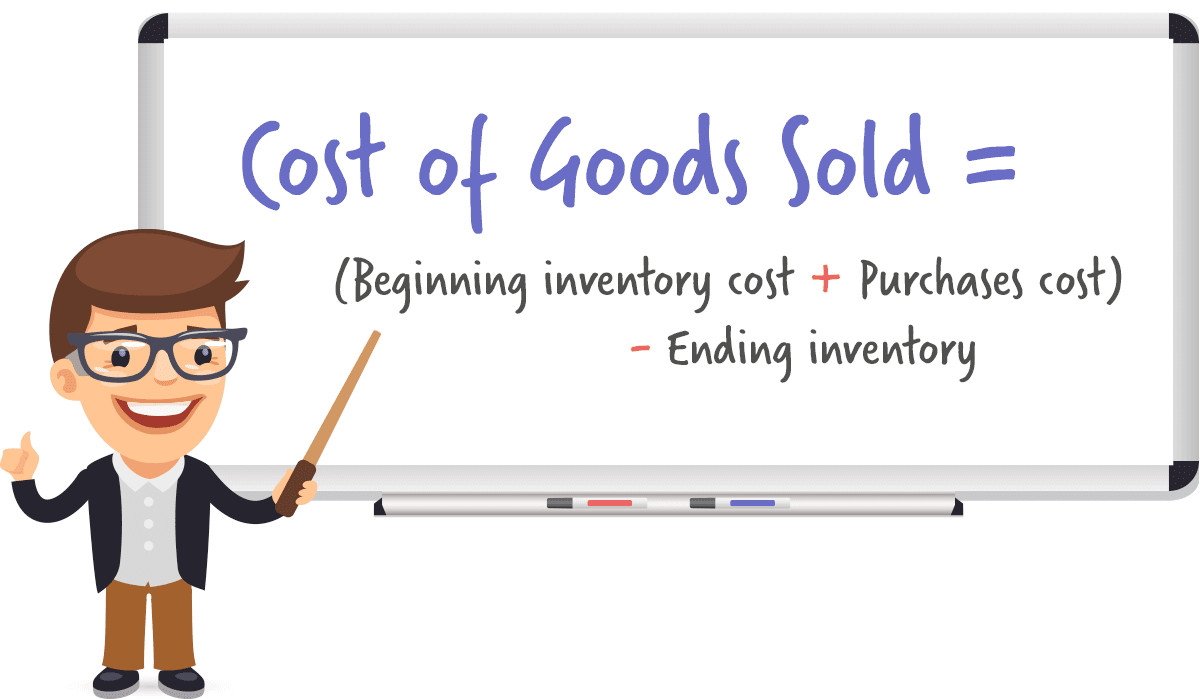

Calculating COGS

To calculate cost of goods sold (COGS) for an accounting period, you'll need to:

Determine what costs can be associated with the production process of your specific products - like labor, raw materials, tools, etc.

Take the cost of beginning inventory (BI).

Add the cost of newly purchased inventory during the period in question.

Subtract leftover, unsold inventory at the end of the accounting period.

2) Ending inventory (EI)

It's highly likely that a business will not sell the entirety of its inventory at the end of each accounting period. Meaning any on-hand, unsold stock becomes an asset that must be valued and included in financial statements.

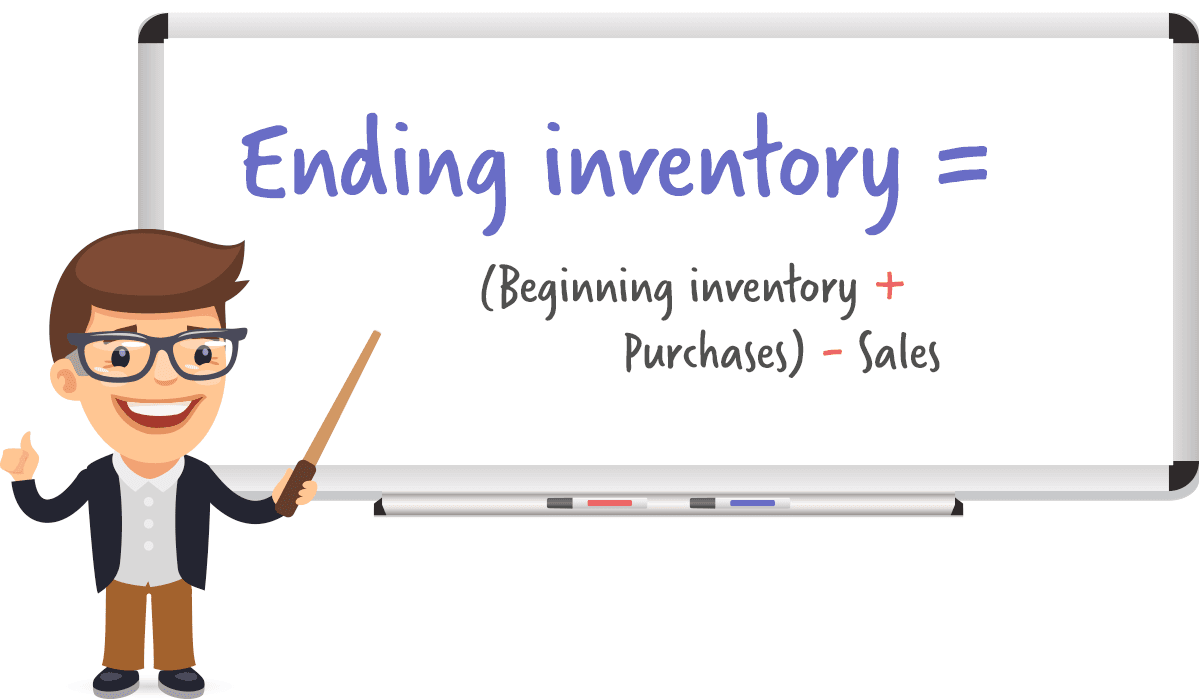

This is referred to as ending inventory (EI), and is actually quite simple at first glance.

Take the beginning inventory (the units carried over from the end of the previous financial period).

Add any newly purchased inventory throughout the accounting period.

Subtract any units sold.

And this leaves the final inventory figure to be included as a company asset.

However:

We need to assign an actual value to the unsold inventory figure (i.e. how much this company asset is worth in monetary terms). And this is where it can become a lot more complicated.

This is because:

Numerous purchases of new stock and raw materials are usually made during a typical 12-month accounting period.

Each purchase may have come at a different cost per unit.

Sales are also being made at the same time, turning inventory into cash.

So which cost per unit figure do you use to value unsold inventory when there are so many moving parts in a typical accounting period?

This is where inventory valuation methods come into play.

Inventory valuation methods

Sticking to a specific method for inventory valuation is critical for consistent, accurate and (most importantly) legally acceptable financial statements.

There are three main valuation methods retail companies use for inventory accounting:

First In, First Out (FIFO).

Last In, First Out (LIFO).

Average Cost Method.

You'll just need to stipulate which one is being used when submitting financial records and accounts.

1) FIFO

FIFO is a useful inventory management technique to actually use in the handling of stock in your warehouse. But it's also a method of valuing unsold inventory. f

It assumes inventory that was purchased first, is also the first to be sold. So the oldest on-hand inventory available is what will be used to fulfill an order.

There are a number of benefits to the FIFO method. Primarily, companies selling perishable goods (food and drinks) face less risk of their products spoiling or crossing best-before sale date. They can establish a smooth supply chain and ensure their clients receive the freshest items in their inventory.

All products received and sold must be recorded individually when using the FIFO accounting method. It’s possible that the FIFO system can lead businesses to under or overestimate the value of inventory in the future, due to market changes down the line.

2) LIFO

The LIFO approach works on the assumption that the most recent products added to your inventory are the first ones to be sold first.

This system works well for retail businesses specializing in non-perishable goods or those with a low risk of obsolescence. It can also increase COGS and lessen net profit (therefore reducing annual tax liability) if more recently purchased goods are more expensive.

Note: LIFO is an acceptable inventory accounting method in the US only.

You can learn more about LIFO vs FIFO in this video:

https://www.youtube.com/watch?v=ffn16zUTVFo

3) Average Cost

Average Cost (or weighted-average) inventory accounting method is totally different to the previous two.

This applies to businesses that choose not to track cost per inventory unit for each separate purchase delivery. Instead, inventory value is based on the average cost of items throughout the relevant period.

You can work out the average cost by simply dividing the overall cost of products for sale by the total number in the inventory.

You can learn more about the Average Cost method in this video:

https://www.youtube.com/watch?v=qAWVVw-dC5A

Using inventory accounting software

Inventory accounting can be a time-intensive, frustrating process for retail businesses - especially small or independent teams.

But it doesn't have to be a rush of spreadsheets and paper receipts the week before every tax deadline. There's reliable accounting software available to help automate and digitize as much as possible, the main two being:

These programs won't 'do your accounts for you'. But they will make it much simpler to organize and present come the end of tax year.

Both Xero and QuickBooks do also have tools available to help with the inventory side of accounting.

However:

They are accounting softwares at heart. Meaning the inventory management functionality within them is relatively basic and underdeveloped.

So for growing retail and ecommerce businesses, it's recommended to:

Utilize a high-quality inventory management software as master of stock.

Ensure this software has a direct Xero integration or QuickBooks integration to push relevant data across.

This leaves you with the best of both worlds - two high-quality softwares automating as much of your inventory and accounting processes as possible.

Hopefully, this chapter has given you a good insight into the best inventory accounting practices.

That being said, this can still be a hugely complicated task for retailers. So we highly recommend employing the services of a professional bookkeeper and/or chartered accountant when it comes to compiling financial records and submitting tax returns.

In our next and final chapter, we'll take a look at inventory management systems - including how to determine when it's time to start using an automated system, and choosing the best one for your company.