Ecommerce Success Under New Tariffs and Trade Policies

10 min

- Kaleigh Moore

Imagine this: You’re running a thriving ecommerce business, but overnight, your supplier costs surge by 25%. Margins shrink as prices climb. This is happening right now as we speak. With recent U.S. tariffs driving up costs, ecommerce brands now face a major challenge: absorb the costs, pass them on, or find other ways to adapt.

In this guide, we’ll break down what’s changing around tariffs and trade, which verticals are affected, and the smartest strategies to help your brand thrive despite rising costs.

Understanding the new tariff impacts on ecommerce

The latest U.S. tariff changes are shaking up ecommerce, especially for businesses importing from China, Canada, and Mexico. If you’re overwhelmed by the potential implications and how they will affect your business, you’re in the right place. Let's examine what's happening, how it affects you, and what you can do about it.

Which verticals are affected?

China: higher costs for electronics, apparel, and consumer goods

The U.S. has increased tariffs on Chinese imports, with rates jumping from 10% to 20% on certain products. The hardest-hit categories include:

Electronics (smartphones, laptops, and accessories)

Apparel and textiles (clothing, fabrics, and footwear)

Consumer goods (furniture, kitchenware, and household items)

Canada: steep tariffs on manufactured goods and raw materials

Tariffs on Canadian imports are now 25%, except for energy products, which are taxed at 10%. The affected categories include:

Automotive parts

Industrial machinery

Furniture and home goods

Mexico: increased costs for auto parts and agricultural products

Similar to Canada, imports from Mexico now carry a 25% tariff.

Key affected categories include:

Automotive components (tires, engines, and accessories)

Agricultural imports (fresh produce, processed foods, and raw materials)

How much have tariffs increased?

China: The tariff rate on Chinese imports increased from 10% to 20%, doubling the previous rate

Canada and Mexico: Imports from both countries now incur a 25% tariff, except for Canadian energy products, which are subject to a 10% tariff.

Timeline for implementation

The implementation of tariffs took place on March 4, 2025.

On April 2, 2025, the U.S. plans to introduce "reciprocal" tariffs targeting countries with significant trade barriers against U.S. products.

Ecommerce supply chain adjustments to offset higher costs of tariffs impact

With a foundation of what’s changing in place, next, let’s look at what ecommerce brands can do to offset the increased costs that come with modifications to tariffs and trade policies.

1. Cutting operational costs without hurting growth

During the peak of the 2008 financial crisis, Starbucks faced plummeting profits. However, rather than simply raising prices, CEO Howard Schultz cut inefficiencies—from supply chain logistics to how baristas steamed milk—saving millions without sacrificing quality or customer experience.

Ecommerce brands today face the same conundrum. Rising tariffs, supply chain, and fulfillment costs don’t bode well for margins. But, like Starbucks, you can trim operational costs rather than charging customers more to sidestep the issue.

How do you reduce costs without hurting growth? Here are some key strategies:

Optimize packaging materials. Switching to lighter materials can reduce shipping fees while consolidating packaging will help you fit more items per shipment. You can also eliminate unnecessary inserts and use recyclable materials to appeal to eco-conscious customers.

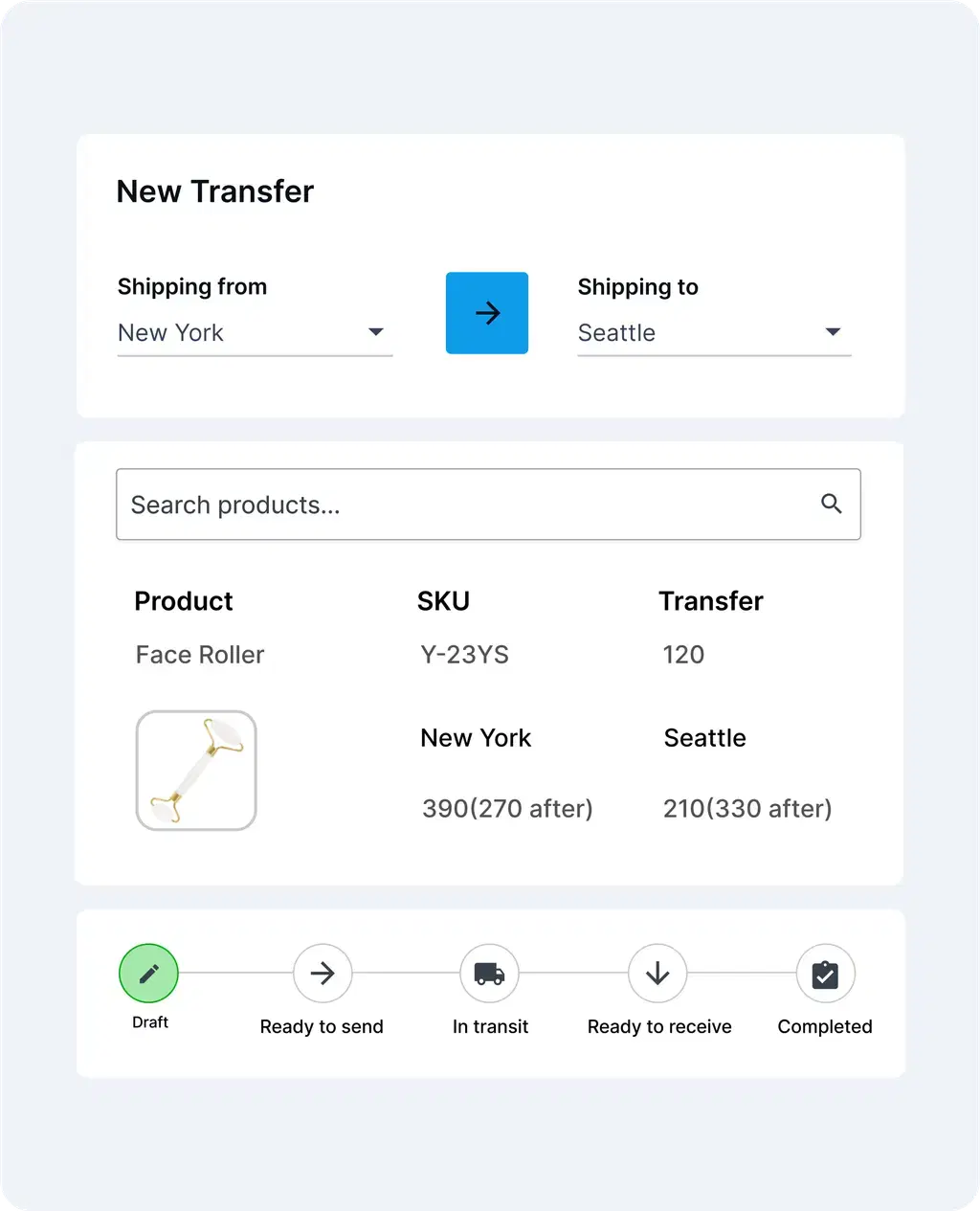

Eliminate inefficiencies in fulfillment and operations. Many businesses unknowingly overspend on logistics, warehousing, and inventory management. You can leverage ecommerce inventory management software like Veeqo to automate inventory tracking, helping prevent overstocking or missed sales from understocking.

Using Veeqo to track stock across multiple warehouses (Source)

Audit operation expenses. Conduct regular audits of software subscriptions and supplier contracts to discover potential savings. This is where tools like Veeqo Profit Analyzer can make a difference. For example, WeSupplyDIY, an ecommerce brand, struggled to track costs and profitability before adopting Veeqo. However, with shipping cost calculations and real-time insights into profit and expenses, the company could pinpoint superfluous costs, helping it adjust its pricing strategy and improve margins.

“For the first time, the team could see everything in one place with the click of a button—every fee, cost, and margin,” explains Morris Sitt, Director of Ecommerce at WeSupplyDIY. “It breaks down our shipping fees, our FBA fees, our referral fees, our long-term storage fees, and our ad spend. There are a lot of fees and costs that go into selling on Amazon. Ultimately, if you don’t have the right tool, you're not going to know what you're spending on all of them.”

2. Renegotiating with suppliers

Walmart built its empire on one principle—buy low, sell low. The retail giant achieved this by mastering negotiations with suppliers, allowing Walmart to secure low prices by committing to high-volume purchases. That said, you don’t need to commit to Walmart-level purchasing power to make negotiations work in your favor.

If you can promise consistent large orders or consolidate purchases across multiple SKUs, many suppliers will be willing to lower prices. Show them your future projections and historical order data to justify a discount.

However, if you can’t guarantee bulk buying, negotiate extended payment terms so you can get more time to pay your invoices. If you have a solid payment history, the supplier might agree to extend the standard 30-day payment window to 60 or even 90 days. This gives you breathing room to sell inventory and invest in marketing and operations without taking on debt.

3. Adjusting pricing without losing customers

Rising tariffs mean rising costs but passing those to customers can backfire. If done wrong, you risk losing market share and customer trust. But if done strategically, you can protect margins while maintaining loyalty.

Brands with strong margins can consider absorbing tariffs to avoid losing market share or brand loyalty. For example, Apple, despite rising import costs on Chinese-made components, sometimes absorbs tariffs on key products like iPhones instead of passing them to consumers.

But price adjustments need to be more subtle if you can’t absorb the cost. Here’s what you can do instead:

Start with gradual, small increases: Instead of a one-time, steep increase, increase prices over time to prevent customer churn. Research from McKinsey on the S&P 1500 shows that a 1% price increase can drive an 8% increase in profits—a far more significant impact than cost-cutting or increasing sales volume. Even a 5% price rise can boost profitability by more than 20%, showing how small adjustments compound over time.

Premium positioning: Justify price increases with improved product positioning, premium packaging, or better customer service. For example, Away, the luggage brand uses limited edition drops to create exclusivity and drive higher pricing. These collections sell out fast, with customers paying a premium for unique designs that won’t return—allowing them to reinforce brand value and raise prices without pushback.

Using exclusive product drops to raise prices (Source)

Bundle pricing: Offer bundles or value packs to make price hikes feel less conspicuous.

4. Sourcing from alternative countries

China has long been the go-to source for global manufacturing, but the ongoing trade war and rising tariffs are forcing businesses to rethink their supply choices.

Amid the tariff tensions, here are some of the emerging sourcing hubs you can rely on:

Vietnam and Thailand are ideal for apparel, electronics, and furniture manufacturing. Vietnam is now the second-largest clothing exporter to the U.S. after overtaking China in specific categories.

India emerges as another rising player famous for its textiles, pharmaceuticals, and IT industries. Apple also anticipates shifting nearly 25% of global iPhone production to India by 2025.

Mexico’s location makes it especially attractive to businesses, as it drastically shortens shipping times to the US. While Mexico is facing tariffs, the USMCA trade agreement exempts duties on many goods, making it a relatively attractive option compared to China.

Australia is a strong alternative for businesses needing high-quality raw materials, such as minerals, dairy, and wool. While labor costs are higher, its political stability and strong trade agreements with the U.S. make it attractive for long-term sourcing.

Pro tip: Start small with a dual-sourcing model. Rather than relying on a single source, outsource shipping from at least two countries. For example, Adidas has bases in multiple countries, such as Vietnam, Indonesia, and India, helping it reduce its dependency on China alone.

5. Considering nearshoring or reshoring

When tariffs and global trade wars drive up shipping costs, nearshoring (moving production closer to key markets) or reshoring (bringing manufacturing back home) emerge as viable options.

While the labor cost may appear cheaper overseas, nearshoring and reshoring can help you reduce shipping costs, supply chain risks, and compliance costs, positively affecting your bottom line. Before making a decision, carefully weigh the pros and cons of a localized supply chain.

In fact, many companies are now realizing the importance of domestic production. A report by Capgemini reveals that 62% of organizations view domestic manufacturing as essential for strengthening strategic industries like electric vehicles, pharmaceuticals, and semiconductors. Nearly 47% of companies have already invested in reshoring their manufacturing or production.

Industry-specific government incentives can further support reshoring efforts. For example, the U.S. CHIPS Act is driving domestic semiconductor production by offering subsidies and tax breaks to manufacturers. Depending on your industry, similar incentives can help ward off transition costs.

Communicating changes to customers

Raising prices, changing logistics, and adjusting shipping costs can be tricky—and relaying the information to customers can be trickier. However, being upfront and highlighting the benefits will help customers accept the changes and understand the reasons behind those changes.

Be transparent about price increases: Customers will likely accept price hikes when they understand the “why” behind them. Clearly explain rising costs (e.g., raw materials, inflation), highlight added value (quality, sustainability), and give loyal customers early access to current pricing.

Setting clear expectations for shipping delays and costs. Provide estimated delivery times before checkout, real-time tracking, and multiple shipping options to alleviate doubts and make buying easier for customers. This will also take away the ire from increased prices.

Emphasize the benefits of US-based manufacturing. Highlight that localized supply chain and manufacturing give you more control over the quality of your raw materials, resulting in a more durable product. It also makes you less susceptible to inflation since you are exempt from fluctuating exchange rates, rising import tariffs, and overseas labor inflation can drive up costs unpredictably. For example, Rag & Bone built its reputation on American craftsmanship, promoting its Made-in-USA denim as a premium product with superior durability and attention to detail. This messaging justifies higher prices while appealing to customers who value quality and ethical production.

Further reading: Why Global Unrest Drives Local Supply Chain.

Future-proofing your ecommerce business

Ecommerce businesses are scrambling to keep up with changing tariffs. Consumer expectations are higher than ever, and rising fulfillment costs can eat into margins.

The key is to future-proof your business against adversities like inflation and tariffs.

Future-proofing your business means centralizing order fulfillment, streamlining shipping, and leveraging profit analytics to make smarter decisions.

Centralizing fulfillment for speed and cost savings

Managing multiple sales channels—Amazon, Shopify, Walmart, eBay—without a unified fulfillment strategy can lead to costly errors. This fragmented system isn’t sustainable either, as it leads to frequent stockouts, overselling, fulfillment delays, and increased operational costs—ultimately hurting both profitability and customer satisfaction.

That’s where centralized multichannel shipping and inventory management platforms like Veeqo come in. It can sync inventory across platforms, update stock levels in real time, and automatically route orders to the best fulfillment center.

For example, if demand spikes unexpectedly or a key fulfillment center experiences delays, automated order routing ensures stock is shipped from the next best location—preventing bottlenecks and lost sales.

The result? Increased supply chain efficiency, lower costs, and better customer experience. And businesses that have insights into their operations and can tap into the best-priced shipping options will always be better positioned to face future tariffs and scale despite inflation.

Tracking profitability with real-time profit analytics

Increasing sales and cutting shipping costs through inventory management is only one part of future-proofing your business. Another task is to cut out redundant expenses to protect profitability.

And this is where Veeqo’s profit analyzer can help. It provides free profit analytics across Amazon FBA, Amazon FBM, eBay, Shopify, Walmart, and more—all in one unified dashboard. You can get insights into sales, revenue fees, cost of goods sold (COGS), and advertising spending without juggling multiple reports. These data-driven reports will help you:

Access every fee and expense in one place, ensuring complete cost transparency.

Identify the most (and least) profitable SKUs, optimizing your product mix.

Spot wasteful spending on PPC ads, excessive FBA fees, or storage costs, making data-driven decisions to protect margins.

Further reading: How to Forecast Your Ecommerce Business Sales.

Navigating the tariff changes and staying ahead

The policy shift around the U.S. tariffs is reshaping e-commerce in the country. Brands are looking for ways to offset this cost and transition to a more localized supply chain without disrupting the profit margins too much. The key is adaptability, whether absorbing higher costs, diversifying suppliers, or streamlining operations.

One way to stay ahead is to optimize your inventory and shipping process. Veeqo makes it easy by offering a free, all-in-one solution that helps you track inventory, analyze profit margins and expenses across channels, sync stock levels, and connect with multiple carriers—preventing overselling and streamlining shipment operations.

With Veeqo, you can stay competitive without the logistical headaches. Sign up to Veeqo for free and take control of your fulfillment process today.