Powerful Inventory Management Tools

Improve fulfillment efficiency and customer satisfaction by preventing stock-outs, forecasting customer demand, automating inventory tasks, and keeping inventory up-to-date across your marketplaces, stores and locations.

Smart order routing

Fulfill orders from the location nearest to your customer to deliver products faster and reduce shipping costs. Veeqo will calculate the shortest distance between a delivery address and your locations with available inventory and then instantly allocate inventory to the customer. The feature also ensures that, before it allocates a location, there is stock available at that warehouse or distribution center so fulfillment is seamless.

Time-consuming spreadsheets out, Veeqo in

Veeqo automatically manages your inventory levels across Amazon, eBay, Shopify and Walmart to ensure that you know:

Exactly what you have in stock - What you've sold and on what marketplace

What you could sell more of

What's not selling

Wave goodbye to the manual world of spreadsheets and let Veeqo do the work.

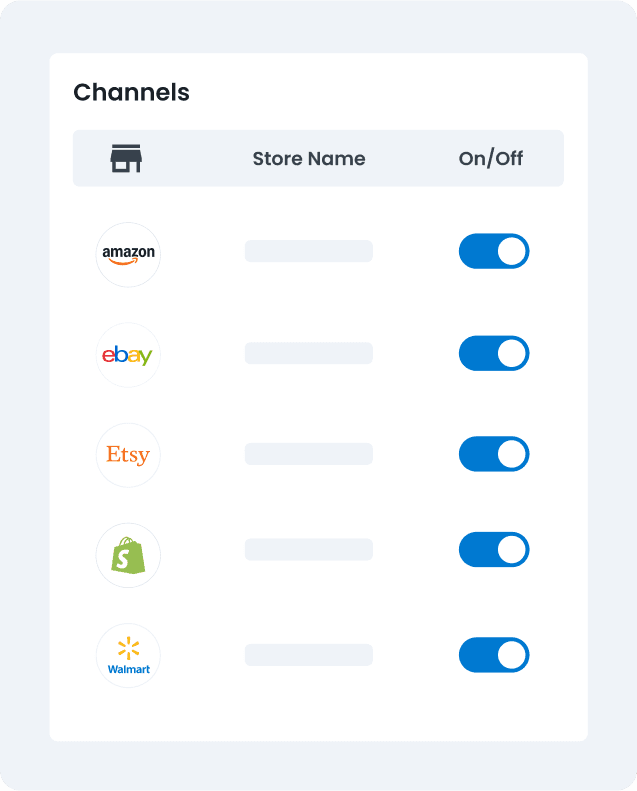

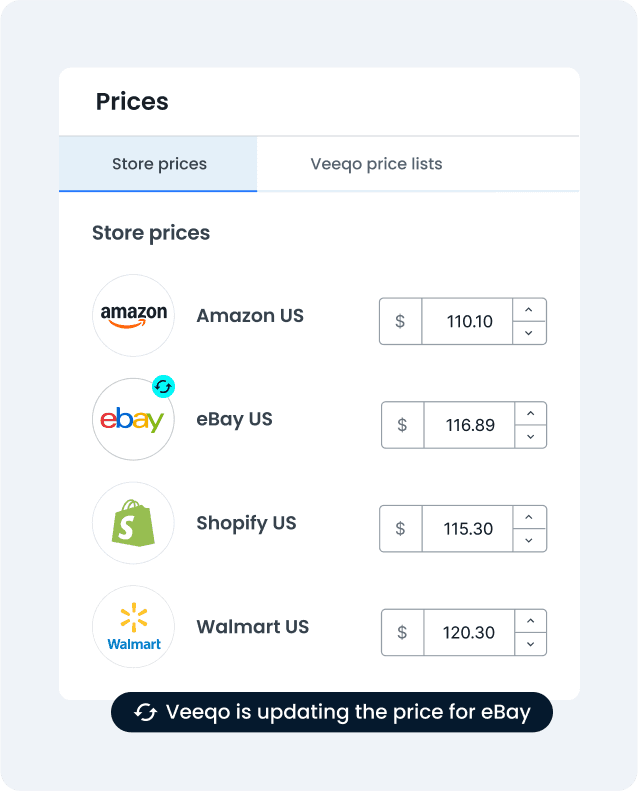

Adjust stock and listing prices in once place

Update stock and prices for products on every marketplace and store you connect to Veeqo, saving you hours of manual admin time.

Your carrier, marketplace and store data —all in one place

Veeqo simplifies and scales your shipping needs with customizable warehouse workflows, trusted carriers, and connections to all selling channels and marketplaces you require.